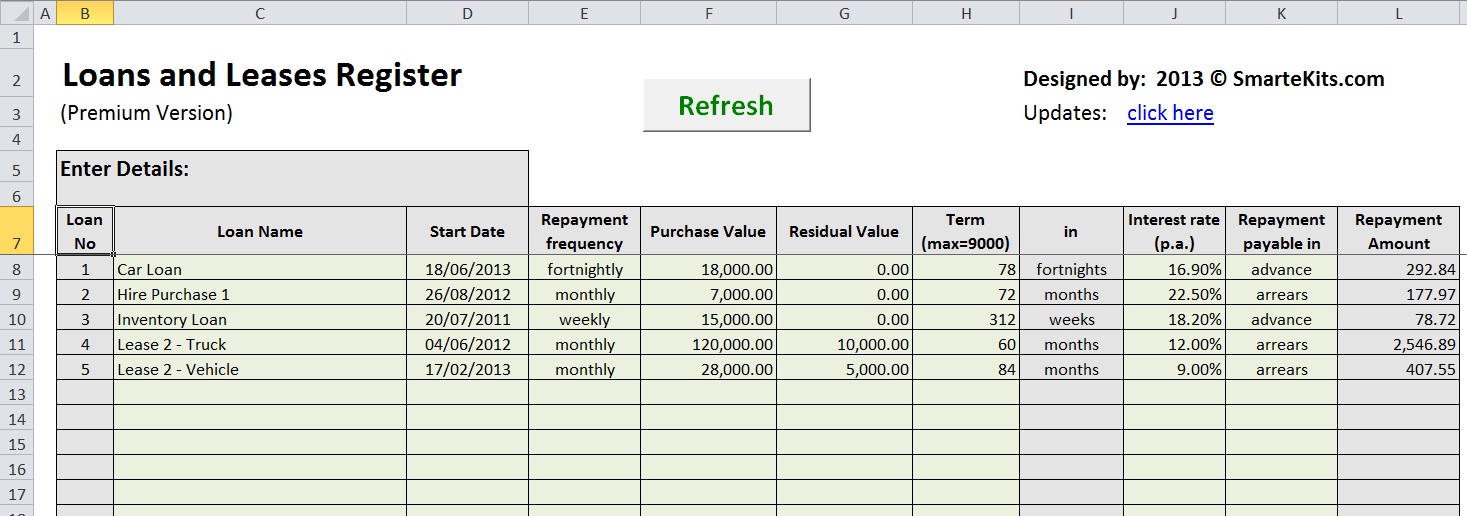

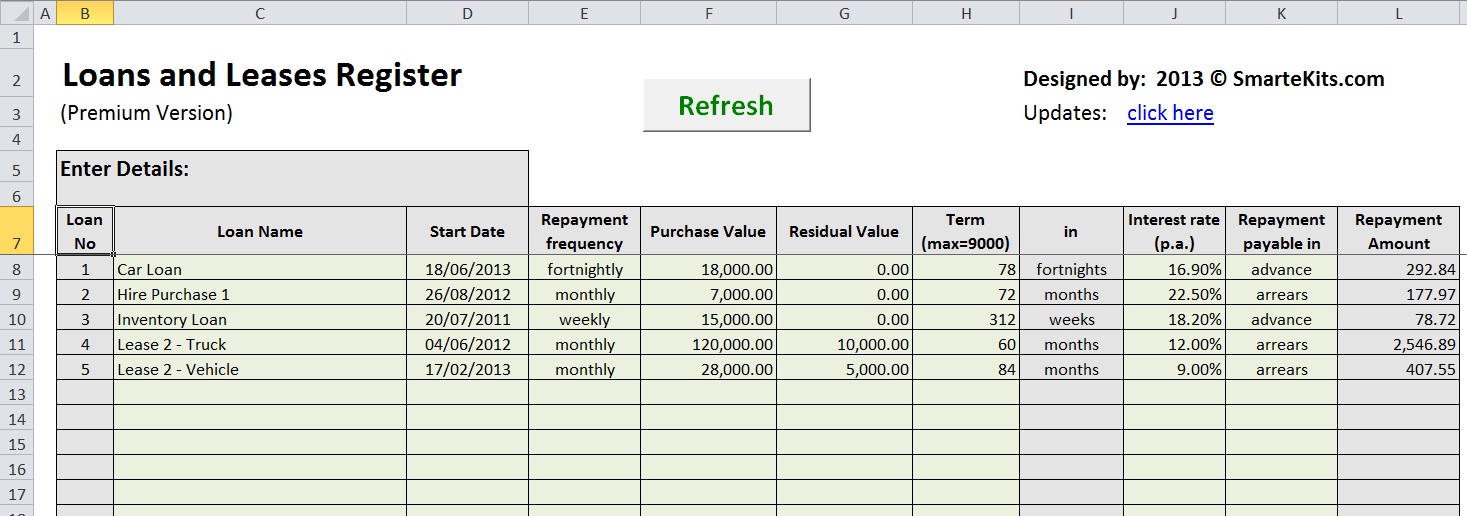

Loan amounts vary widely between industries 5 000 5 000 000.

Capital equipment lease calculator.

Capital vs operating lease in the u s.

Leasing is a popular method of acquiring new equipment for your business.

We partner with plenty of.

With our calculator you can choose from three of the most popular equipment lease types to calculate your payments.

If you are looking for an equipment leasing solution and you want to know what your monthly payment would be use our easy to use equipment lease calculator.

Nothing on this website is a representation or guarantee of.

We used our work with more than 75 lenders to inform calculator estimates for your equipment loan.

The benefit of a capital lease or finance agreement is that the customer may deduct 1 000 000 in equipment purchases to offset taxable income.

Use national capital leasing s calculator to determine an approximate monthly payment on a 1 00 buyout option.

The bonus depreciation adds further benefit above this amount.

Click the run button.

Like to talk shop.

Use this calculator to find out.

The leasing calculator automatically provides you with the approximate monthly payments for a lease term of two to five years.

Although the payments may seem attractive it may not always be the best financial decision versus purchasing the equipment outright and financing it with a low.

We calculate monthly payments and your total net cost.

How much you can borrow depends on the type of equipment you re financing its lifetime value and whether it s new or used.

A capital lease is a lease of business equipment that represents ownership and is reflected on a company s balance sheet as an asset.

Should you lease or buy.

Providence capital funding inc understands that as a business owner you need to know what options are available to you to help you succeed.

In the context of business leasing there are two different types of leases.

Our lease with the 1 00 purchase option and equipment finance agreement would qualify under section 179.

Use our lease vs buy calculator to help make your business equipment decisions should i lease or buy equipment.

The 1 buyout lease a capital lease in which the lessee makes fixed payments each month and then has the right to purchase the leased equipment for 1 at the conclusion of the lease period.

Instantly calculate your lease or loan monthly payment options for equipment trucks or software with our free online equipment finance calculator.

The financial calculator and visual aids above are provided as tools for your independent evaluation of prospective capital investments.